It’s a characteristic feature of the resource industry that no two orebodies are the same and consequently no two projects are the same. The development of resource projects requires the investigation of a vast range of issues across a variety of engineering and geoscience disciplines, as well as factors such as environmental, social and governance (ESG), marketing, legal and commercial. But the principal purpose of mining studies is to determine whether development opportunities make good business sense, not just whether they are technically and economically feasible, and that they can be constructed and operated in a sustainable manner.

For Boards to approve shareholder funds, the value proposition of an investment opportunity must be fully understood by the decision makers and presented with full transparency. A sustainable project strategy and risk-to-reward profile must meet corporate criteria so that an informed decision can be made with respect to progressing the project to the next phase of study. The project evaluation has to be based on the level of risk and the accuracy of the forecast of outcomes. The project must also be aligned with the company’s business strategy.

The more shareholder funds are made available to evaluate an investment, the greater the level of accuracy and confidence to decide to advance the project. The question then becomes how much to invest, and how to achieve a well-defined framework to assist in this decision-making process. The right decisions start with right questions and having the best data available at the right time. It’s critical to be sure you’ve got the right project before you develop it.

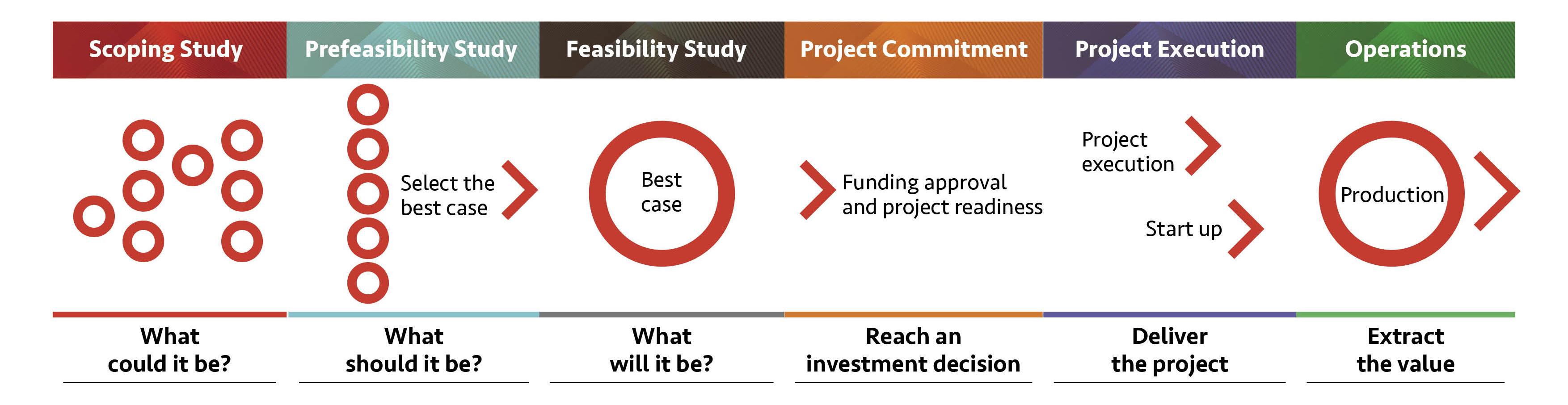

Experience has shown best practice is adopting a phased, step-by-step approach to the evaluation of potential options to expend shareholder funds effectively and efficiently. With any potential investment there is a need to identify flaws, key risks and knowledge gaps to determine if the investment should advance or whether different options should be developed and restudied.

To minimise the chance of delivering anything short of a successful project, a mining study needs to ask the following questions:

- What could it be? – explore a range of potential options for investment

- What should it be? – investigate and evaluate different processes, capacities, locations and configurations to determine the best business case to meet business goals, and then recommend if further evaluation is warranted

- What will it be? – consider whether the final project that achieves adequate return on investment is a sustainable value proposition that makes whole-of-business sense.

The right decisions start with the right questions and the right data at the right time. A disciplined and rigorous approach to the evaluation of capital investments can help achieve successful project delivery.

Learn more about Enthalpy’s Capital Investment System.